Real Estate Investment Trusts, or REITs, are a popular way for regular investors to participate in commercial real estate.

Generous yields, relatively low volatility, and steady dividend growth can make certain REITs some of the best high dividend stocks for investors seeking retirement income and capital preservation.

This is why larger, famous REITs, such as Realty Income (O), are often core holdings in high-yield income portfolios.

However, the world of REITs is a large one, which is why sometimes it’s worth taking a look at smaller names, such as STORE Capital (STOR).

Let’s take a look at STORE to see why its strong fundamentals have attracted the attention of none other than Warren Buffett, history’s greatest investor, who recently purchased a 10% stake in the company. Investors can review Buffett’s dividend portfolio here.

Specifically, learn if this small but fast-growing REIT may have what a diversified, high-yield portfolio needs, especially at today’s valuations.

Business Overview

STORE Capital (which stands for Single Tenant Operational Real Estate) is a relatively new triple net lease REIT, having gone public in 2014.

However, it’s led by a management team with 35 years of experience in the industry, having built three previous triple net lease REITs (tenants pay all taxes, maintenance, and insurance costs) with a total of 9,100 properties.

Today, STORE owns 1,826 properties in 48 states leased under long-term contracts (average remaining lease is 14 years) to 382 companies in 102 industries.

STORE’s rent is derived from:

- 69% services (restaurants, daycare centers, fitness centers, movie theaters)

- 18% retail

- 13% manufacturing (business parks)

Business Analysis

There are three keys to most successful dividend growth stories in real estate: a stream of dependable cash flow, a strong balance sheet, and a long-term focused, conservative management team whoknows how to balance growth and dividend safety, as well as adapt to shifting industry conditions.

When it comes to triple net lease retail REITs (such as Realty Income and STORE), many investors have become worried over the large number of retail bankruptcies and store closings (the most since the financial crisis), which the media has dubbed “the retail apocalypse”.

In fact, according to Fung Global Retail, in the first half of the year, 29 retail chains announced they were closing 4,381 stores across the U.S. However, while such headlines might scare Wall Street, quality retail REITs such as STORE actually appear to be well insulated from the carnage.

That’s because they have extremely diversified property portfolios, with very little exposure to distressed retail.

In fact, the vast majority of STORE’s rental revenue is derived from service-oriented businesses, which are largely immune from the disruptive growth of e-commerce.

The remainder of STORE’s properties are similarly Amazon (AMZN) resistant because even the company’s small amount of retail exposure is largely in areas that continue to thrive, such as furniture, farm supplies, and hunting and fishing stores.

In addition, STORE’s management team, which has decades of experience running triple net lease REIT portfolios, has taken a highly disciplined approach to the types of tenants it targets so that 75% of its tenants are investment grade (only 46% of Realty Income’s (O) tenants can say the same).

Such conservatism reduces the risk of tenants being unable to pay their rent and makes them more capable of accepting rent increases over time.

Additionally, STORE is very careful about making sure that each store’s tenant is financially healthy, targeting conservative unit level fixed charge coverage ratios (tenant cash flow over fixed charges including rent) of 2.0 or greater.

In other words, STORE management is highly disciplined in its growth approach, making sure to only rent to tenants who are unlikely to fail and stop paying rent. This is why its occupancy rates have not only been among the highest in the industry, but highly stable for several years, including during the recent retail industry downturn.

However, what’s even more impressive about STORE is that, despite management’s exceedingly high acquisition standards, the REIT operates in a massive and highly fragmented market, which means plenty of opportunity to grow through acquiring new properties and renting them out to rock solid tenants over time.

In fact, of the $2.6 trillion commercial real estate market, publicly traded triple net lease REITs own only about 4%. STORE’s management team has located approximately $12 billion in potential acquisitions, which represents about 10 to 12 years of growth potential for the company.

The key to STORE’s success has been not just fast growth, including adjusted funds from operations or AFFO (the REIT equivalent of free cash flow) per share (10.1% annually since IPO) and the dividend (8.6% annually), but management’s Warren Buffett-like dedication to not overpaying for new properties.

Management’s deep industry connections mean that the company can source new acquisitions from private markets at far lower prices than many other REITs, resulting in cash yields on new properties that are significantly higher. For example, so far in 2017 STORE’s cash yield has been 7.8% compared to Realty Income’s 6.5%.

That may not sound like much, but in the highly levered world of commercial real estate, such small differences can add up. In this case, STORE is the most profitable REIT in its industry.

There are two drivers of to this impressive profitability. First, management has the patience and connections to source highly profitable acquisitions at above-average cash yield rates.

However, the other factor is the disciplined approach the REIT takes to paying out its dividend. Specifically, STORE Capital retains a larger than average proportion (most peers retain just 10% to 20%) of AFFO to fund growth.

There are three reasons why STORE benefits so much from this high percentage of retained cash flow. First, it’s important to remember that REITs, by law, must payout 90% of taxable income (not the same as AFFO) as dividends to avoid paying corporate taxes.

In other words, REITs are high-yield pass-through stocks, designed to distribute the majority of cash flow to shareholders. However, that means that in order to grow, REITs must constantly access external capital markets (i.e. issue debt and sell new shares).

Anytime capital is constantly being raised, as it is with practically all REITs, it can be easy for low quality management teams to hide poor capital allocation decisions by paying dividends out of freshly raised debt or equity capital, as well as grow the property base even if it’s dilutive to existing shareholders (as some externally managed REITs do).

Essentially, the new rental income generated by the properties bought with new debt or issued shares isn’t high enough (due to low cash yields on new properties) to offset the greater share count, which raises the cost of the dividend.

Or to put it more simply, a company’s AFFO per share, which is what secures and grows the dividend over time, can fall if a REIT’s cost of capital is too high and its cash yield on new investments is too low.

In the case of STORE Capital, it’s retention of so much cash flow not only makes for a highly secure dividend (more on this in a moment), but also means less dependence on debt and equity markets, as well as lower overall costs of capital and thus greater profitability.

In fact, thanks to STORE’s large amount of retained cash flow and its leading annual rent escalators (built into the leases), the REIT is capable of growing its AFFO organically (without external capital) by 5.2% a year.

STORE’s fundamentals are so strong and its management team so skilled that none other than Warren Buffett’s Berkshire Hathaway (BRK.B) took a 9.8% stake in the REIT, an enviable stamp of approval for one of the best (if lesser-known) industry names.

The bottom line is that STORE Capital appears to represent one of the fundamentally strongest companies in this high-yield industry.

Key Risks

While STORE Capital’s low risk business model makes it a potentially solid choice for conservative income investors, there are a few risks to be aware of (as there are with any stock).

The first is that while STORE’s tenant base is largely immune from current industry challenges (the decline of brick-and-mortar retail), that doesn’t mean its heavy focus on services isn’t exposed to economic weakness, such as when consumer spending falls during a recession.

While it’s true that STORE’s management team has excelled at long-term value creation through numerous economic cycles in the past, STORE’s short history has thus far been purely during a steady (if slow) economic recovery.

While the REIT’s conservatism means the company is very likely to survive the next economic downturn, its industry-leading growth rates could certainly take a hit. That in turn could cause the share price to tumble.

This isn’t a problem for investors with long time horizons (say 10+ years to retirement) or large enough portfolios to live entirely off dividends, but if your portfolio is small and you need to periodically sell shares to fund living expenses (such as with the 4% rule), then this short to medium-term risk is something to be aware of as you think about portfolio diversification.

Another risk is that triple net lease REITs happen to be among the most interest rate sensitive REITs in the sector. This is because the very long-term leases that underpin their steady and predictable cash flows (new leases are generally for 15 to 20 years) also create a higher beta to yield (i.e. their stock prices react more severely to movements in interest rates).

Based on the data below, for each 1% increase in the 10-year U.S. Treasury yield, STORE capital’s dividend yield can be expected to rise by about 1.47%, meaning the share price would be expected to decline (perhaps somewhat meaningfully) over the short-term.

The reason behind this is twofold. Fundamentally, higher interest rates generally mean greater inflation, and because triple net lease contracts are locked in for up to two decades, this means that the escalator rate (how much rent rises each year) may not keep up with inflation.

This also means that triple net lease REITs, which are often used by yield-hungry investors in a low interest rate environment as bond alternatives, can be thought of as very long-term duration bond proxies.

And just as long-term bond prices decline as interest rates rise (because new investors demand the yield on old bonds matches those of newly issued, higher yielding ones), the same can be true (though not always) for triple net lease REITs such as STORE Capital.

The good news is that, unlike what many people think, rising rates don’t necessarily impair a REIT’s fundamentals. That’s because quality management teams (such as the one at STORE) are able to successfully adapt to higher interest rates and continue to grow steadily in any rate (or economic) environment.

This is because higher interest rates generally mean that property prices could temporarily decline, and thus the cash yield on investment increases. Thanks to STORE’s skilled use of long-term fixed rate debt, the net cash spread (cash yield minus cost of capital) generally stays the same, allowing for profitable growth of AFFO per share and thus the dividend.

However, remember that this is only in the long-term, and unfortunately if your time horizon is shorter, than short-term drops in share price can be determinantal, both financially and psychologically.

This is why, if your portfolio isn’t large enough to generate sufficient dividend income to cover expenses (thus making you more price sensitive), it can be a good idea to review your asset allocation plan and maintain one to two years worth of expenses in cash. This can help an invsetor ride out any short-term REIT share declines, as well as any market corrections.

STORE’s Dividend Safety

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

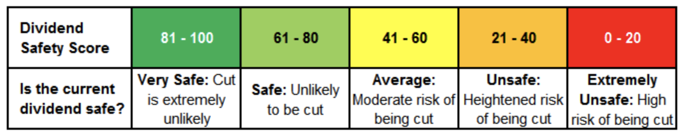

Our Dividend Safety Score answers the question, “Is the current dividend payment safe?” We look at some of the most important financial factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more.

Dividend Safety Scores range from 0 to 100, and conservative dividend investors should stick with firms that score at least 60. Since tracking the data, companies cutting their dividends had an average Dividend Safety Score below 20 at the time of their dividend reduction announcements.

We wrote a detailed analysis reviewing how Dividend Safety Scores are calculated, what their real-time track record has been, and how to use them for your portfolio here.

STORE has a Dividend Safety Score of 66, indicating a safe and dependable dividend. This is a due to three main factors.

The first is the company’s very consistent and dependable stream of rental revenue and AFFO generated by STORE’s highly diversified collection of long-term leases, from high-quality tenants.

Even more beneficial is the fact that STORE actually has the longest duration leases in the industry, and it has the least concentrated rent base of all its major peers with just 12% of rent coming from its top five tenants.

However, even more important is the REIT’s very conservative AFFO payout ratio (dividend dividend by AFFO per share). Throughout its young life, STORE’s payout ratio has seldom been higher than 70%, indicating a strong safety buffer for the dividend.

In fact, among all major triple net retail REITs, STORE Capital’s payout ratio is the lowest, which helps give it such a relatively safe dividend.

Last but not least is STORE’s fortress-like balance sheet, exemplified by its very low leverage ratio (Debt/ EBITDA) and one of the highest interest coverage ratios in the industry.

STORE Capital actually source its debt from both unsecured bonds (which are BBB rated with a stable outlook) and on a non-recourse basis, meaning that its individual properties are collateral for loans taken to buy them.

The benefit to this approach is that unlike corporate debt, which includes strict debt covenants that can force dividend cuts in the event of a liquidity crunch, debt collateralized by individual properties, in the event of a default, simply mean the lender forecloses on that individual store.

In other words, non-recourse debt limits STORE shareholders’ liability and helps ensure the dividend remains intact, even in a worst case scenario (non-recourse loan default).

The bottom line is that STORE’s industry-leading diversification and ultra long-term leases (with the highest annual escalators as well), give it incredible cash flow predictability and stability.

When combined with the industry’s lowest payout ratio and one of the strongest balance sheets (ensuring plentiful access to low cost debt growth capital), STORE’s dividend appears to be on very solid ground, even despite its rather limited dividend track record.

STORE’s Dividend Growth

Store has one of the fastest dividend growth rates over its short life, courtesy of its very strong pace of new property acquisition, which has translated into impressive growth in AFFO per share.

The company’s quarterly dividend has grown more than 20% since the start of 2015, including a 7% boost earlier this year.

Given the long and large growth runway STORE currently enjoys, investors can likely expect it to continue generating 6% to 7% annual dividend growth over the coming decade. While this is slightly below the REIT’s historical 8.6% growth rate, it’s likely to continue making STORE a growth leader in this high-yield sector.

Valuation

Over the past year, STORE Capital has underperformed the S&P 500 by about 20%, which isn’t surprising given the market’s pessimism about retail REITs and concern over rising interest rates.

However, note that since news broke that Buffett bought a tenth of the company back in July of 2017, shares have rallied about 25% off their 52 week lows. However, just because STORE isn’t as cheap as it once was doesn’t mean its valuation is no longer attractive.

In fact, STOR’s price/AFFO ratio (REIT equivalent of a P/E ratio) is just 15, which is both below the 18.2 forward P/E of the S&P 500, as well as the stock’s historical norm of 15.4.

In addition, STORE Capital’s P/AFFO continues to be lower than several slower growing blue chip rivals.

Furthermore, the dividend yield of 4.8% is about in the middle of its historical range, although its trading history admittedly isn’t very long.

Considering its business quality, long-term growth opportunities, and Buffett stamp of approval, STORE’s stock appears reasonably priced.

STORE shares purchased today have potential to long-term annual total returns of 9.8% to 11.8% (4.8% yield plus 5% to 7% annual earnings growth).

Conclusion

Before Buffett bought his stake in the company, not many investors had heard of STORE Capital.

However, while the young upstart REIT is far from earning the label of a blue chip, its disciplined management team, industry-leading profitability, healthy balance sheet, and solid dividend growth potential mean that STORE Capital could be a worthy investment to keep an eye on for a diversified income portfolio.

With the stock’s current valuation appearing reasonable, especially relative to the REIT’s high quality, today could be a good time to more closely evaluate STORE.

Leave A Comment