Founded in 1949 in Canada as IPL Energy (changed name to Enbridge in 1998), Enbridge (ENB) is North America’s largest midstream energy company. Enbridge’s network of oil & gas gathering, storage, processing, and transportation systems connect the continent’s most vital oil & gas producing regions.

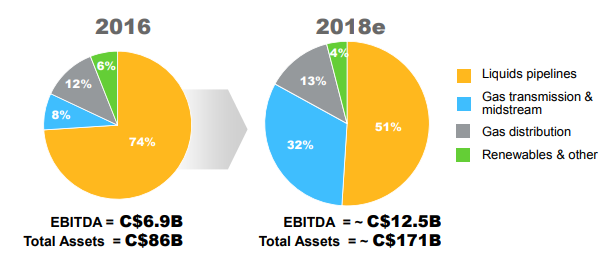

By division, liquids pipelines are expected to account for 51% of 2018 EBITDA, followed by gas transmission & midstream (32%), gas distribution (13%), and renewables and other (4%).

Enbridge is structured as a conglomerate, composed of numerous subsidiary MLPs and energy funds which it helps manage. These divisions also raise funds independently of the parent company in exchange for management fees, distributions, and incentive distribution rights (IDR) fees.

The company’s assets service a large portion of North America’s oil & gas needs. For example, Enbridge is responsible for moving 20% of all natural gas consumed in the U.S., is the largest natural gas transporter in Canada, and has pipelines that handle approximately 65% of U.S.-bound Canadian crude oil exports.

Enbridge is especially dominant in its home market, where it operates the Canadian Mainline pipeline system. This network represents 70% of all Canadian oil pipeline capacity. Mainline has a capacity of 2.85 million barrels of oil per day and connects to 3.5 million barrels per day of refining capacity across North America.

However, Enbridge isn’t just a midstream company, but rather an increasingly global and diversified energy empire. For example, thanks to the company’s $22 billion acquisition of Spectra Energy in 2016 (which brought with it Union Gas), Enbridge is also Canada’s largest natural gas utility in Central and Eastern Ontario, Quebec, New Brunswick, and Northern New York State, serving 3.5 million customers.

You can see that Enbridge’s cash flow mix became much more diversified into natural gas after the company bought Spectra Energy.

In addition, Enbridge is aggressively expanding into renewable energy. This includes solar, wind, and geothermal, both in North America and increasingly in Europe.

Note that on January 22, 2018, Spectra Energy Partners (SEP) and Enbridge Inc, which serves as Spectra’s sponsor and general partner, announced an agreement in which Spectra would buyout Enbridge’s general partner stake and incentive distributions rights in exchange for additional units worth about $7.2 billion.

This was done to simplify the MLP’s capital structure, permanently lower its cost of capital, and allow for longer and stronger payout growth in the future. After this deal, Enbridge now owns 83% of Spectra’s units.

Business Analysis

The midstream industry is one that enjoys numerous competitive advantages for several reasons.

First, it’s highly capital intensive, with major projects often costing billions of dollars to complete. This means that large players like Enbridge, with vast access to low-cost capital, have a major advantage over smaller rivals.

The other moat creating advantage is the highly regulated nature of the business. For example, pipeline projects usually transit several states, and even various countries (some span from Canada to Mexico). As a result, various state, local, and federal regulators have to sign off on new construction. This is why the average regulatory approval takes three years, and sometimes far longer.

Most projects don’t get approved unless there is an obvious need, creating relatively little overlap of pipeline systems. In other words, pipeline companies and MLPs enjoy an oligopolistic cost structure that that helps ensure good returns on capital.

The nature of midstream cash flows is also important to understand. Companies like Enbridge basically serve as toll roads, with very little direct commodity exposure themselves. Enbridge usually won’t start construction on a new project unless they’ve already locked up volume commitments from oil & gas producers under very long-term (10 to 25-year) inflation-adjusted fixed-fee contracts.

Enbridge’s empire of pipelines is safer than most of its rivals, with just 4% of its cash flow being exposed to commodity risk. As importantly, its customers are almost all large, well capitalized, investment grade companies (over 90% of revenue). This limits the potential for its clients to go bankrupt and default on their contracted payments.

Enbridge also has done a good job limiting its interest rate sensitivity. Most midstream companies pay out the majority (85% to 95%) of distributable cash flow (similar to free cash flow and what pays the distribution) to investors. This means that the midstream industry is one with a high need for external capital funding (via debt and equity issuance).

Enbridge has been highly disciplined with its use of debt over the years. Today 85% of its bonds are fixed-rate, and the company estimates that each 1% rise in long-term U.S. interest rates would cause its adjusted cash flow from operations, or ACFOO (what Enbridge calls its DCF), to decline by only 2%. The company has also been working to decrease its leverage from purchasing Spectra Energy.

For example, in 2016 the company’s leverage ratio (debt/EBITDA) hit 6, which is about the industry average. However, leverage came down to about 5.5 in 2017, is expected to decline to 5.0 in 2018, and ultimately fall to a very conservative 4.5 in 2020.

All told, the predictable nature of its cash flows, with very little commodity, counterparty, and interest rate risk, is why the credit rating agencies give Enbridge a BBB+ (or equivalent) investment grade credit rating. This is tied for the highest in the industry and allows the company to borrow at an average rate of just 3.9%, representing one of the lowest costs of debt in the midstream space.

The long-term thesis for Enbridge is ultimately about its strong growth prospects. The company bought Spectra Energy in 2016 to gain access to its enormous network of U.S. natural gas pipelines. These have an average contract length of 13 years and have minimal no commodity exposure.

The Spectra acquisition also increased Enbridge’s growth project backlog to $27 billion. In 2017 Enbridge put into operation $9.7 billion in new projects, with another $17.6 billion planned to go online through the end of 2020.

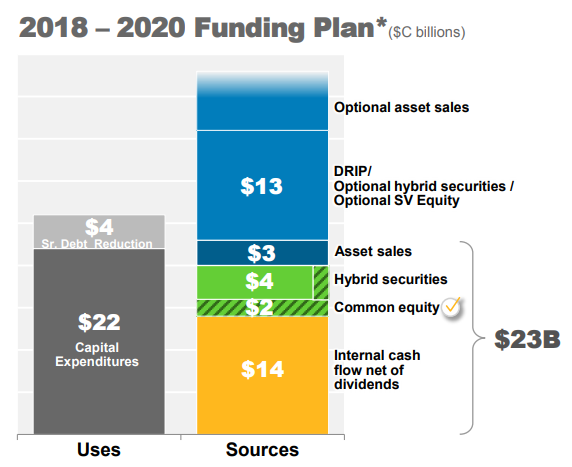

Enbridge has recently completed its latest three-year strategic review, which included raising about $11 billion in capital in 2017. Management is now confident that it has all the funds it needs to complete these projects (which will grow Adjusted EBITDA by 21% in 2018 and 8% in 2019) without the need to sell new equity, reducing some of its risk.

In fact, Enbridge has always been one of the most conservative midstream companies when it comes to funding more of its growth internally. While most of its peers only retain 5% to 15% of internally-generated cash flow to fund growth (distributing the rest to unitholders), Enbridge has plans to retain 35% to 45% of its ACFFO. Combined with a modest amount of low-cost, fixed-rate debt, this should allow the company to complete its growth plans independent of fickle equity markets.

As a result of all these factors, Enbridge has a very solid track record of paying generous, safe, and fast-growing dividends. In fact, the company raised the dividend 15% in 2017 and 10% in 2018. Management plans to increase payouts by 10% in 2019 and 2020 as well.

Impressively, the 2018 dividend increase marked the company’s 23rd straight annual pay bump, and management continues to target a conservative payout ratio below 65% of ACFFO.

Beyond 2020, Enbridge still expects to be able to grow relatively quickly with mid-single digit payout growth likely due to three factors. First, Enbridge estimates that its excess ACFFO (after dividends) will be over $5 billion a year by that time.

That should provide plenty of growth capital to fund its post 2020 shadow growth pipeline, which the company estimates could be as large as $30 billion.

Enbridge’s substantial growth pipeline (by far the largest in the industry) isn’t likely to shrink anytime soon, even as the company completes these projects. That’s because North American energy production is expected to boom for decades, driven by the fracking revolution and Canadian oil sands (proven reserves in excess of 170 billion barrels).

In fact, the International Energy Agency estimates that by 2040, $700 billion to $900 billion in additional North American midstream infrastructure will be needed to service our continent’s growing energy production. All of which means that Enbridge’s growth runway could prove to be very long and keep its dividend growing at a nice pace for the foreseeable future.

Overall, Enbridge’s generous and fast-growing dividend, overseen by one of the most disciplined management teams in the industry, could make it an appealing long-term high-yield income investment for some investors.

However, like all companies, Enbridge faces several major hurdles and risks in the future.

Key Risks

U.S. investors in Enbridge need to understand two important things pertaining to its dividends.

First, Canadian companies withhold 25% of dividends to U.S. investors. Fortunately, a tax treaty between the U.S. and Canada lowers this rate to 15%. In addition, U.S. investors get a $300/$600 (individual/couple) dollar-for-dollar tax credit for foreign dividends withheld.

In other words, while your Enbridge dividends will be 15% smaller than the stated value, most investors won’t have to pay the IRS any taxes on them. Since the U.S. qualified dividend tax rate is 15% for most investors (20% for the top tax bracket), this means that the foreign tax credit will effectively offset the Canadian withholding tax. For Enbridge shares held in retirement accounts (such as IRAs), there is no dividend tax withholding.

The second thing to understand is that as a Canadian company, Enbridge pays dividends in Canadian dollars. This creates some foreign currency risk when dividends are paid (they get converted from Canadian dollars to U.S. dollars at the prevailing exchange rate).

For example, when the U.S. dollar weakens against the Canadian dollar (as it did from 2011 to 2016), U.S. investors actually received more U.S. dollar-denominated dividends.

However, recently the U.S. dollar has been gradually appreciating in value relative to the Canadian dollar. A stronger dollar could somewhat lower Enbridge’s effective payouts to U.S. shareholders.

As for risks to the company itself, there are two worth considering. First, due to the highly capital intensive nature of this industry, Enbridge must occasionally finance its growth plans with equity capital (sell new shares).

The ultimate profitability of its projects (and thus the ability to hit its ACFFO and dividend growth targets) is based on the difference between the cash yield on its investments and its cost of capital.

A lower share price raises the equity portion of this cost, which means that Enbridge’s growth potential is somewhat at the mercy of fickle stock market sentiment. In late 2017, Enbridge raised about $4.7 billion in total equity/preferred capital at attractive rates after midstream stocks had rallied strongly.

Today management says that the company doesn’t anticipate needing to raise more equity capital to complete its $17.6 billion growth plans through the end of 2020. As you can see, management’s funding plan leans the most on internal cash flow, the company’s DRIP, and issuance of hybrid securities.

While that means Enbridge’s medium-term growth is theoretically less dependent on the stock market’s unpredictable sentiment, management’s guidance is not necessarily guaranteed to hold.

That’s because it’s based on timely completion of the company’s major growth projects, which need to come in on time and at or under budget. In reality, regulatory delays in projects can push back completion dates and lead to cost overruns that might force Enbridge to raise additional equity capital.

If Enbridge’s share price is too low, say because oil prices fall or interest rates rise high enough to hurt all high-yield dividend stocks (as they largely did in 2017), then Enbridge’s cost of capital might end up rising.

As a result, its project profitability might come in less than expected. That ultimately means that Enbridge’s ACFFO per share growth might be slower, causing the company to miss its current 10% dividend growth guidance.

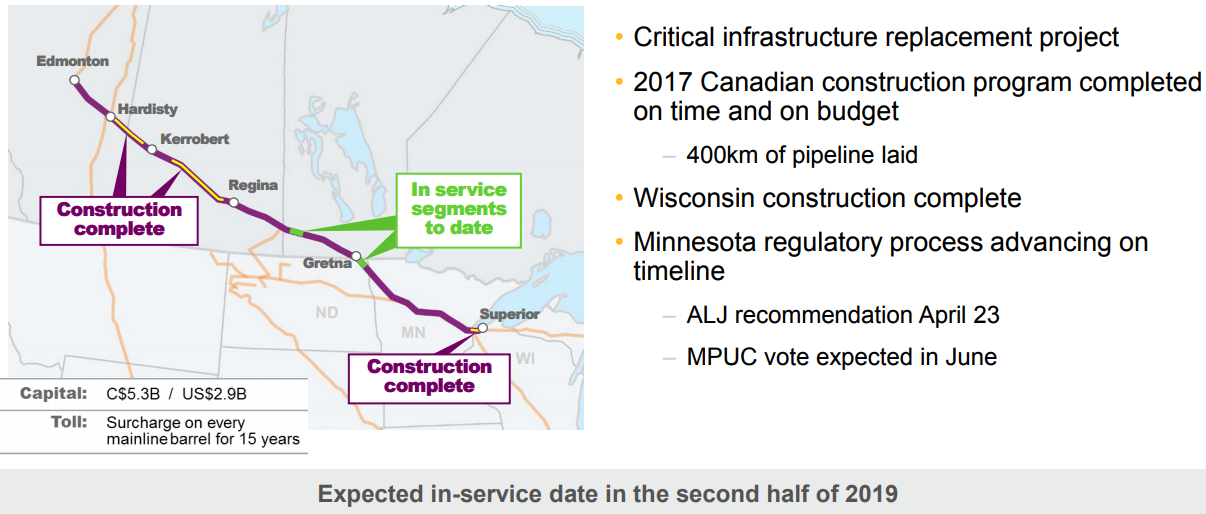

Perhaps the biggest risk to Enbridge, or any major midstream stock, is regulations. Specifically, the construction of major pipeline projects, such as Enbridge’s $6.5 billion Line 3 replacement, has already been delayed by the Minnesota Public Utility Commission (MPUC).

The MPUC had previously said it would decide on final regulatory approval for the project in April of 2018. However, in December of 2017 the commission rejected Enbridge’s environmental impact study as inadequate and gave the company 60 days to revise three sections.

Specifically, the commission is worried over the possible risks of increasing climate change and oil spills. While the pipeline is still eventually expected to be completed, Enbridge has recently stated the regulatory delay might push back the completion date by up to a year (Q3 2019 instead of Q3 2018).

And it’s not just U.S. regulators that potentially pose a risk of holding up Enbridge’s plans. One of Enbridge’s largest service regions is the Athabasca oil sands of Alberta, Canada.

In late 2017, Alberta regulators unveiled new carbon emission rules designed to lower the province’s CO2 output 19% by 2030. Oil sands production accounts for over 20% of Alberta CO2 emissions and large emitters will now be forced to pay a carbon tax.

This means increased costs for Alberta oil sands producers, which lowers profits. Because of a lack of midstream infrastructure to transport oil to markets, Canadian crude is usually much costlier than U.S. and international oil prices. This means that Canadian producers are more sensitive to the volatile swings in energy prices than their U.S. counterparts.

Should oil prices once more fall significantly, then the higher-cost Canadian oil sands projects (which will now become even more costly) might not make economic sense. Fortunately, Enbridge has locked up the volume contracts for its current growth project backlog. Therefore, its cash flows from these projects are theoretically safe barring major bankruptcies in the Canadian oil industry.

However, if the Canadian oil sands producers suffer, that may decrease demand for future growth projects and ultimately dampen Enbridge’s long-term dividend growth.

Closing Thoughts on Enbridge

Enbridge has proven itself to be one of the best-run midstream companies in North America. The business has enjoyed predictable cash flow for many years thanks to its long-term, commodity price-insensitive contracts with investment grade customers. Its acquisition of Spectra Energy provides greater diversification and scale, which should help the combined company in the years ahead.

Despite its appealing long-term dividend growth track record, focus on regulated pipeline and utility businesses, and impressive rate of payout growth expected over the next few years, income investors need to respect the industry-specific risks faced by Enbridge.

Specifically, the company still depends on favorable capital market conditions to help fund its growth and generous dividend (albeit much less than its pipeline peers), faces regulatory risks with several of its major growth projects, and must deal with an energy market that appears to have structurally changed thanks to the rise of U.S. shale production, which could materially affect the economics of Canada’s oil sands development projects in the future.

Enbridge possesses a number of qualities that make it attractive from a yield perspective (including a conservative payout ratio and investment grade credit rating), but more conservative income investors considering the stock should make sure to size their positions accordingly given some of the unique risks in this space.

To learn more about Enbridge’s dividend safety and growth profile, please click here.

Leave A Comment